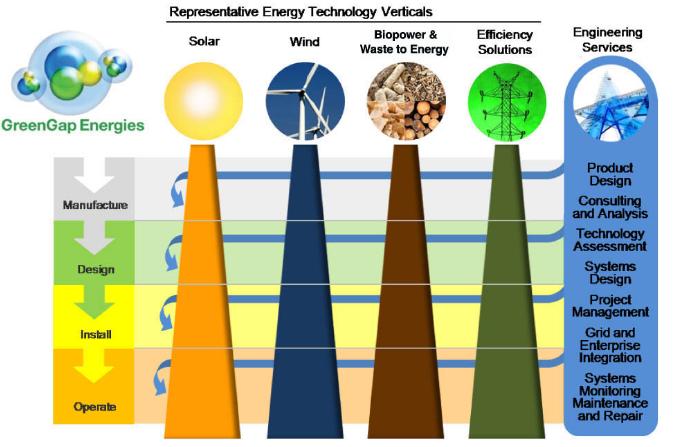

GREENGAP AGGREGATION MODEL

ENHANCED GROWTH AND MARGINS VIA BI-DIRECTIONAL INTEGRATION

GreenGap’s acquisition model involves aggregating multiple clean tech verticals and horizontally connecting shared energy services and common infrastructure across the verticals. This bundling approach compounds the financial and market efficiencies of vertical integration with the additional value enhancement of shared horizontal resources.

GreenGap’s bundling strategy enables any of our portfolio companies to make use of GreenGap’s IP, its global supply chain and buying power, its existing engineering resources, established sales channels and financing capabilities.

Separately, GreenGap’s acquired companies can deliver a wide range of clean tech solutions ranging from on and off grid power for commercial and residential use; commercial, industrial fuel cell technologies; water purification and waste energy systems. Together, the GreenGap Group can deliver an unbiased package of price competitive renewable energy solutions tailored to address a host of regional, geographic and competitive conditions. GreenGap cross-trained installation teams can install any of a number of GreenGap company systems at reduced costs and GreenGap energy consulting services can advise clients not only on its choice of technology deployment but also on how best to capitalize on current government clean energy incentive programs. Multiple cross-selling of energy technologies translates into revenue enhancement for the GreenGap Group. Bundled energy services will deliver large recurring revenues and superior margins and returns.